Each semester, the Mack Institute’s Collaborative Innovation Program (CIP) brings Wharton and Penn students into some of the world’s top companies to solve organizational challenges. This past semester (Fall 2021), students consulted on a diverse lineup of live business challenges in industries ranging from metalworking to green banking.

The projects offer a window into the biggest trends, opportunities, and potential pitfalls in business strategy and innovation management. Below, we’ve rounded up some of the most interesting insights and key takeaways from our student consultants’ projects.

Theme 1: Embracing New and Emerging Technologies

Anticipating and implementing relevant new technologies is a persistent theme in innovation management. One of the Fall ‘21 groups worked with a leader in the home service trades industry (HVAC, electric and plumbing) to help understand and enter the burgeoning smart home technology market. Part of their research included an analysis of target markets for smart home devices based on home ownership status, income, and willingness to adopt technology.

Excerpt from Report:

The smart home technology market has expanded rapidly in the last few years and is expected to grow 13% CAGR over the next five years to $50 million. There are many opportunities in this market. We identified three priority segments of potential customers. Specifically, these are “Power Users” and “Trusting Users” who represent current buyers and “Smart-Home Beginners” for longer term opportunities. Together, the three segments account for 80 percent of the total market. In terms of demographics, Power Users and Trusting Users tend to live in urban or suburban areas, enjoy higher levels of income, have started families, and tend to work from home – benefitting from the conveniences of smart devices. Moreover, these segments have indicated plans to move or renovate their homes within the next 12 months, providing an opportunity to sell and install smart devices. In contrast, Smart-Home Beginners tend to be younger and have lower discretionary income, but are technology-savvy and are likely adopters of smart home devices as they become homeowners.

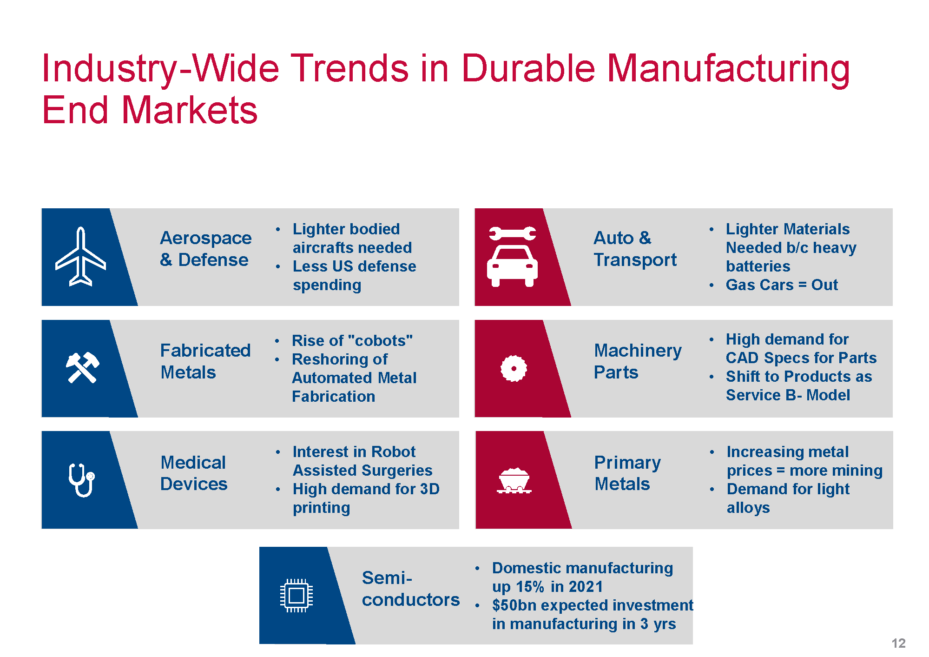

Another Fall 21 CIP project worked with a leading North American distributor of industrial metalworking supplies. The team analyzed the firm’s ecommerce strategy and provided an analysis of how the most successful ecommerce tactics from major players like Amazon could be incorporated into a highly specialized B2B environment.

Excerpt from report:

Company D operates in an intensely competitive environment, where customers have many options to choose from, and loyalty is hard to earn. Outperforming competitors requires that the company builds an advantage that is sustainable and offers greater value to the customers. To identify such opportunities, we looked to companies such as Amazon, Disney, and Nike, which have been tremendously successful in building a loyal customer base, for insights relevant to Company D. These companies have devised intelligent and creative ways to insert themselves into their customers’ lives, leveraging physical and virtual tools. Amazon’s Dash, Nike’s Chip, and Disney’s magic band are all examples of such products. Additionally, each one has designed their e-commerce ecosystem to promote retention and loyalty by building an interconnected set of activities/channels and placing the customer at the center of the ecosystem.

We believe that a systematic investment in Connected strategy would offer Company D a distinct advantage over its competitors. In a connected world, Company D would strategically deploy its services and applications to continuously learn and respond to the needs of its customers, collect and mine valuable data, offer smart product recommendations, build loyalty, and increase customer’s WTP. To get there Company D should prioritize investment in these high impact differentiators:

-

- In-house Data Science and Analytics capabilities: Building machine learning and AI solutions to offer enhanced shopping experience, predictive analytics, and opportunity assessment

- Experimentation culture: Data-driven decision making, A/B testing capabilities, etc.

- Omnichannel E-commerce

We’ve also identified some short-term investment opportunities that will enhance customer’s shopping experience and increase Company D’s revenue. This includes areas such as SEO, home page optimization, price-matching, and ease of navigation.

Theme 2: Environment, Sustainability, and Governance

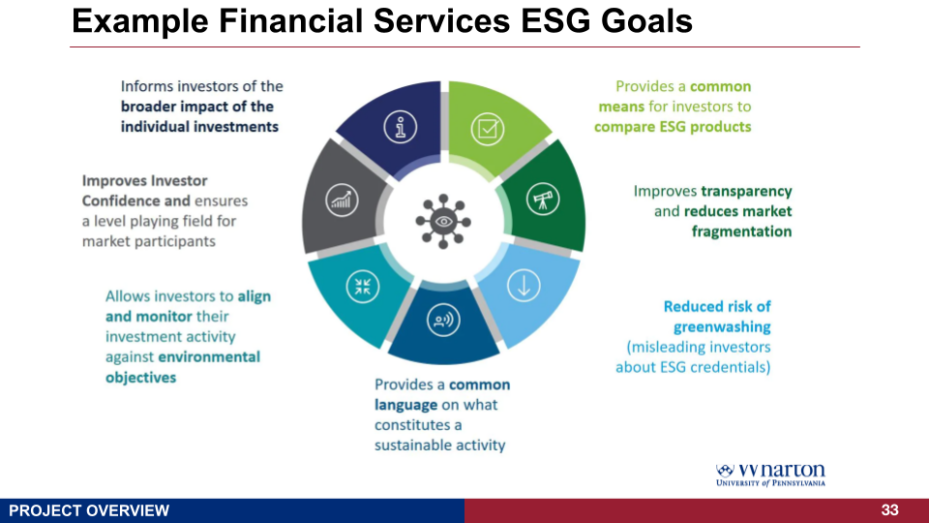

Sustainability is one of today’s most pressing issues, and many firms participate in CIP with the goal of creating a greener business model. In one Fall 21 project, a CIP team worked with a major bank to incorporate ESG foundations into their platform strategy. The CIP team analyzed the successes of competitor banks, identified areas of expansion and potential pitfalls, and also developed a model for incorporating local carbon offset programs into the platform.

Excerpt from report:

Global Organizations in banking and asset management are setting the ESG backdrop worldwide. With this, under the Biden administration’s “US Net Zero 2030” initiative, the US public sector has established a strong foothold for ESG support. We would like to focus further on how the largest US banks execute on this ESG grand vision, and facilitate their historical capital commitment to finance ESG strategic projects coast to coast. UN leads the way globally as 95 banks across 30 countries join forces under its Net- Zero Banking Alliance, combining $66 Trillion in AUM. Net Zero Asset Managers Initiative follows closely by combining $57 Trillion in AUM from 220 asset managers as signatories internationally. Ceres plays a key role in the US, focusing on major ESG initiatives across major industries.

These have accelerated the US public sector, from the White House to regional governments, to make their ESG push. California Cap-and-Trade has been well integrated with many local businesses looking to become carbon neutral, with the added Carbon Offsets, to position California at the forefront of ESG push. East-Coast regional governments also put themselves on the ESG map with 9 states joining forces under RGGI.

Zooming in on major banks in the US, while Bank of America has claimed Scope-1 Carbon Neutral in 2019, major US financial firms have pledged major capital- facilitation commitment toward ESG projects in both Public and Private sectors.

Some of the Areas of Focus can be seen in the following:

-

- Green, Social and Blue bond issuances

- Establish and fund in-house climate-innovation and sustainability investing arms Direct financing of ESG strategic projects for private-sector (both privately- held and publicly-traded corporate clients) in Oil, Energy, Auto and Transportation sectors

- Wealth Management (multi-generational wealth) and Real Estate related client segments

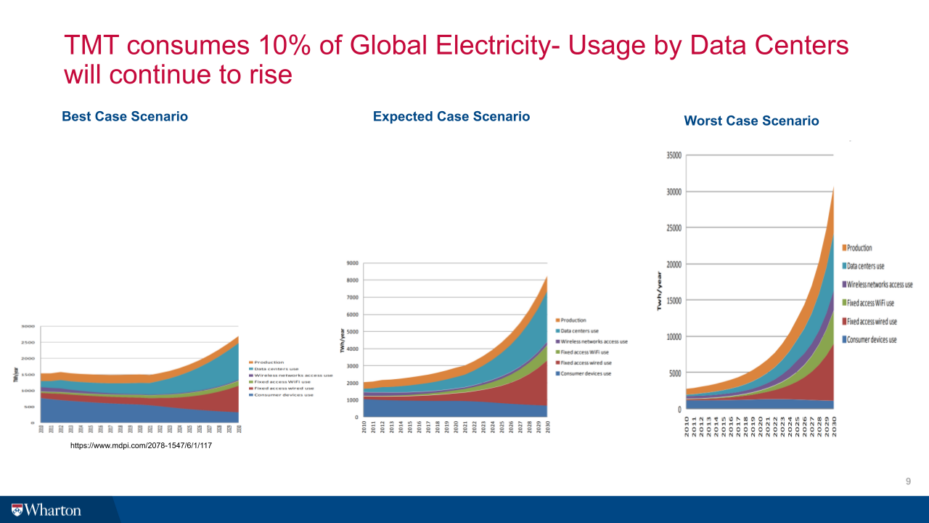

Another ESG project from the Fall 2021 cohort paired students with a global risk management firm specializing in providing insights for digital infrastructure providers and telecom companies. The aim of this project was to explore the strategic roles, responsibilities, and opportunities of tech companies, customers, insurers, investors, and regulators in addressing system-wide climate risks. Their project dug into the macro-level forces impacting climate risk, providing ten case studies from leading Technology, Media, and Telecommunications (TMT) companies.

Excerpt from report:

We identified the TMT drivers contributing to climate change and divided them into three categories: increased energy demand, technology redundancy, and direct environmental impact. We then dig down deeper into which are causing the most significant impact. From the research, it became apparent that the top 5 drivers are as follows:

Energy consumption at data centers: TMT consumes 10% of global electricity, and usage by data centers will continue to rise. Most data centers don’t have plans to use renewable energy, and the ones using it are through Power Purchase Agreements (PPAs) and not a direct investment.

Renewable energy usage % published by tech companies: Even though all big techs claim to be running 100% on renewable energy, are they changing the system to reach this goal, or is it just through renewable energy certificates (RECs_and PPAs)?

Replacement v/s Repair: Technology companies are already feeling pressure from the public and government to make more durable products and release the monopoly on product repairs

Carbon footprints of the supply chain: Carbon is a new currency. More accurate, granular, and timely emission transparency is required to run the business in the future.

Use of digital technology by consumers: GHG emissions from the use of technology are significant, and these scope three emissions will have to be considered by the technology industry in their net-zero pledges.

We also identified some of the challenges the tech industry is facing to get to net-zero value chains and how they’re mitigating their contributions to climate change. in front of the technology industry to get to net-zero value chains. The broader focus in this section was in three main categories:

Addressing increased energy demand: As technology firms are growing at a rapid pace, the increase in energy demand is being addressed mainly by the purchase of renewable energy contracts (RECs). In 2020, Amazon made a huge leap in the amount of RECs purchased to address their energy requirements and also accomplish their goal of powering all their operations with 100% renewable energy by 2025. In addition, efficiency improvements are being made through new technological advancements in the telecom industry (5G technology) and innovative efficiency gains in cloud services.

Addressing e-waste and circular economy: Hardware companies like Apple are focusing on improving the recycling rates of the materials used in their products. By making an assessment of the highest impact materials in their products, Apple was able to address the biggest contributors to their carbon footprint and wasable to recycle a big % of the metals that require energy intensive mining. Partnerships like the Circular Electronics Partnership (CEP)are also trying to establish a framework for circular design which encourages recycling and reuse.

Building Resilience: Firms are building resilience by being open and transparent about the climate change impact on their short and long term finances. Verizon started adopting reporting strategies from the Task Force on Climate-Related Financial Disclosures (TCFD) in 2019 by providing investors and customers with information regarding steps they are taking to address the climate change challenges. By being open and transparent, companies can avoid green swan events and reduce market volatility. TCFD reporting is a step in the right direction, but the lack of clear guidelines make it difficult to compare different firms. European taxonomy is expected to help standardize the terminologies and understand what it truly means to be a sustainable company in the near future.

Theme 3: New Players & Expanding Ecosystems

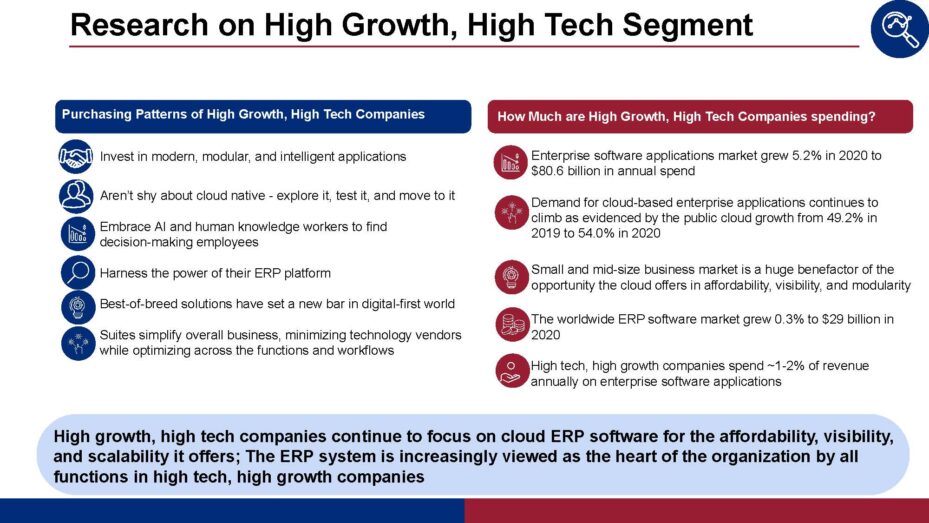

How can companies find the collaborators and clients that help them grow? Partnership and ecosystem strategy is another perennial focus of our CIP projects. One of our Fall ‘21 student groups worked with a multinational software company to create a sales strategy in efforts to attract high-growth, “unicorn” companies — the Fortune 1000 companies of the future. They conducted a number of internal and external interviews, which they then mapped to extensive market research to come up with data-based recommendations for the firm to build out their strategy playbook.

Excerpt from report:

Observations and predictions on the market dynamics of the high tech, high growth segment:

By 2024, 70% of organizations will have transitioned to modular intelligent business suites, harnessing the business processes, data, and innovation across the enterprise in the simplest fashion. By 2023, 40% of Global 2000 Companies will be using their ERP systems as the data and transactional hub for their industry-based ecosystem. This means line-of-business (LOB) executives need to understand the requirements for the digital-first world so they can invest in modern, modular, and more intelligent enterprise applications.

The enterprise software applications market grew 5.2% in 2020 to $80.6 billion in revenue. Demand for cloud-based enterprise applications continues to climb as evidenced by the public cloud growth from 49.2% in 2019 to 54.0% in 2020.

That said, firms face major challenges in Modern B2B technology buyer. Complexity can quash a customer’s motivation to buy, and the field is increasingly complex. Inspiring and maintaining consumer confidence is key to growth. Additionally, over 80% of tech buyers look outside the internal buying committee. Positive representation on blogs, forums, et cetera is crucial, as is the customer’s personal relationship with a firm’s sales team or rep.

Spending Behavior of target segment:

The worldwide ERP software market grew 0.3% to $29 billion in 2020. ERP market growth was uneven in 2020 due to the global COVID-19 pandemic, which caused business disruptions and delayed some IT projects, many of them ERP system purchases. Preferred products remain – travel and expense, payroll and financial suite. As there is no generic basket of enterprise application software that high tech, high growth customers buy so we do not have an estimated number for annual spend for these high tech, high growth customers. Based on a customer interview that we have conducted, it appears that high tech, high growth customers spend ~1-2% of revenue annually on enterprise software applications.

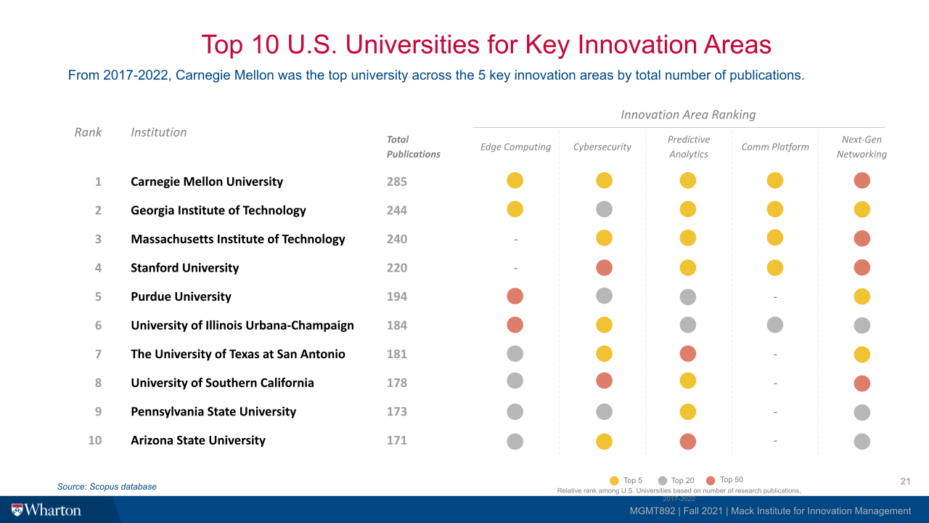

As a leading source of industry-academic collaboration at the University of Pennsylvania, the Mack Institute is uniquely positioned to explore how firms can build lasting relationships with universities that span beyond technology transfer programs. In one Fall ‘21 project, students worked with a leading global digital infrastructure services provider to explore that very issue. Students identified key innovation areas of importance to the client by conducting quantitative and qualitative analyses. They identified top-ranked universities in particular technology areas, researched university engagement models, and organized interviews with technology transfer offices to gain direct insights into their innovation ecosystems. Ultimately, the team drew up a set of strategic recommendations via an engagement playbook and university-specific action points for six specific universities.

Excerpt from report:

University – Industry Partnerships and Engagement Framework

Partnership with universities is built on trust and credibility. Universities have different preferred engagement methods, ranging from having a dedicated external relations team to being incredibly decentralized with the corporation engaging differently with departments and research centers throughout the university. In order to be successful, corporations need to be prepared to commit both human and financial resources to these efforts. Moreover, the corporation must understand the university innovation ecosystem, especially the differences from industry related to culture, speed, and legal (i.e., intellectual property ownership, university indemnification).

The CIP team recommended a two-phased approach to establish broad university engagement to meet the client’s objectives and provide best practices going forward:

Phase 1 consists of foundation building inside firm: Building a dedicated university engagement team (with at least one dedicated role), identifying and prioritizing strategic technologies and finding top universities in areas of focus, defining specific goals for the corporation per technology, and establishing a presence and becoming familiar with the university partnership landscape by joining organizations like University Industry Demonstration Partnership (UIDP).

Phase 2 consists of discovering, landing, and expanding long-term partnerships. This phase entails engaging a wide spectrum of universities in low-touch models that help cast a wide net with low initial risk and resource intensiveness, identifying favored partners among a spectrum of universities, initiating a wider range of partnership models with select universities that the client can commit more resources and time to, and building long-term strategic partnerships with few select partners. There are many examples of low-touch models, including donating data, facilitating student competitions/forums, and becoming a member of a relevant consortium. A unique example of a low touch model involved a retailer providing anonymized data on-loan to Purdue University’s business school (viewed as a gift-in-kind) that opened the doors for further collaboration down the line.

School-specific actionable recommendations

Building university-specific knowledge is crucial for the corporation to establish a relationship with the university. The CIP team has created a template for university-specific battle cards that can be used when evaluating potential partners. These battle cards include university rankings in the client’s key focus areas, examples of corporate partnerships, key takeaways, engagement options measured by potential impact and resource intensiveness, and recommendations for how to initially engage with the university. It is also imperative to build metrics to track relationship value and understand the university’s perspective on partnership growth.

Interested in getting involved in our Collaborative Innovation Program as a student or business leader? Learn more here.