Each semester, the Mack Institute’s Collaborative Innovation Program (CIP) brings Wharton and Penn students into some of the world’s top companies to solve organizational challenges. This past semester (Spring 2022), students consulted on a diverse lineup of live business challenges in industries ranging from hospitality to crypto.

The projects offer a window into the biggest trends, opportunities, and potential pitfalls in business strategy and innovation management. In this series, we’re excerpting some of the most interesting insights and key takeaways from our student consultants’ projects.

by Vishoka Balasubramanian WG’23, Shounak Mishra WG’22, Andres Ramirez WG’23, Jordan Woodard WG’22,

Company Background

Our client, a conglomerate in the developing world with over USD $600M in annual revenues, plans on extending its business footprint into newer ventures that would utilize its current capabilities in high volume production of fuel ethanol and denatured alcohol. The client has invested in doubling its alcohol production capacity from its current level of 107 hectoliters per year to 215 hectoliters per year by 2023.

In order to diversify its customer-base which traditionally comprised other industrial and beverage partners while simultaneously increasing its revenue potential, our client wants to divert 2.5% of its production volume to making alcoholic beverages for consumption by the general public. Eyeing a tremendous demand for alcoholic beverages in the local market, our client launched its first products in Q2 2021. However, traditional alcohol producers, driven by similar market dynamics, have also flocked to the local market increasing competition which has driven down profit margins.

“Eyeing a tremendous demand for alcoholic beverages in the local market, our client launched its first products in Q2 2021. However, traditional alcohol producers, driven by similar market dynamics, have also flocked to the local market increasing competition which has driven down profit margins.”

Furthermore, opportunities for customer segmentation and increasing customer life-time value are in their infancy in the local market. To increase overall profits and ROI, our clients approached the Mack Institute to devise a plan to take their products global. Based on potential for further revenue growth and larger profit margins along with ready availability of raw materials and capacity, two products were selected – craft gin and whisky.

Challenges Of Launching an AlcoBev Product in a Competitive Market

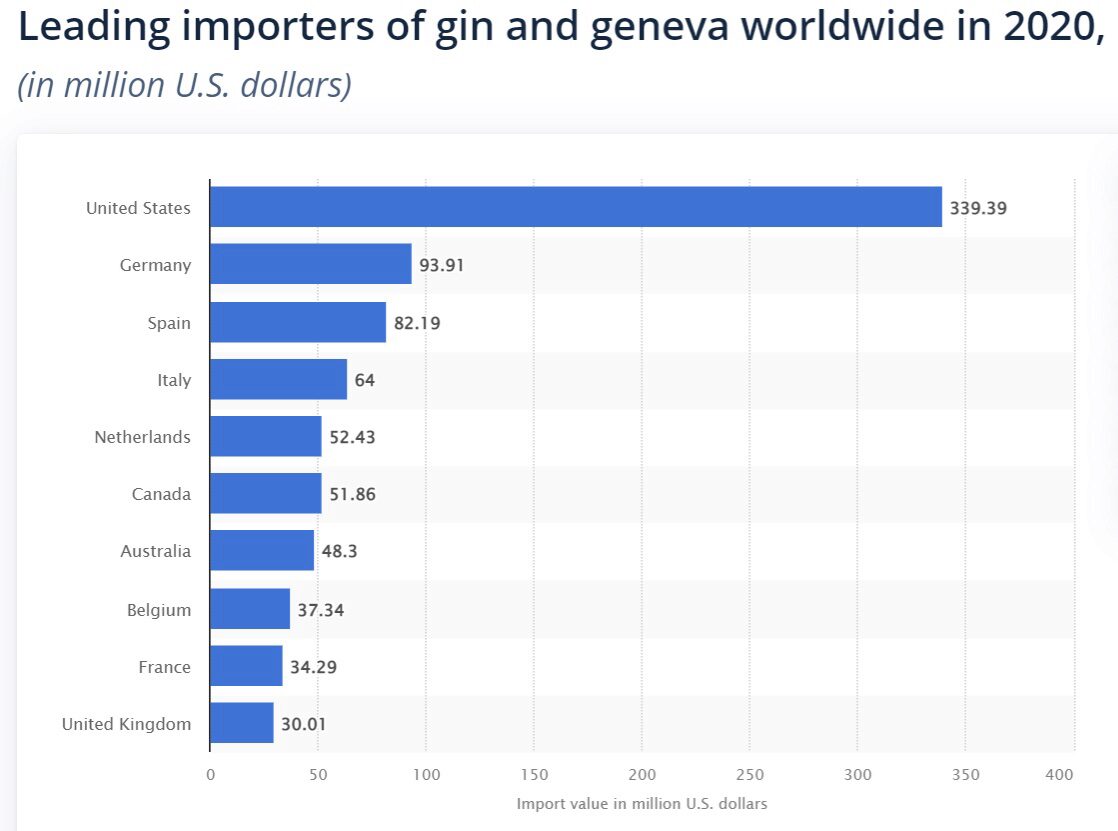

To launch our global analysis, we leveraged Statista to best understand the average and per capita sales volume of premium gins globally. Gin consumption was led by western European countries with high GDPs: Spain, Netherlands, UK, and Belgium. Surprisingly, Ginebra San Miguel, a local Philippine brand, is the leading gin product worldwide though primarily consumed within the confines of the Philippines and excluded from our research.

As we worked with our client, we leveraged the unique search analytics provided by Google Trends to align trending gin brands, gin cocktails, and other relevant gin searches with the sales data extracted from Statista. Doing so allowed us to identify gin-consuming countries growing in popularity that weren’t necessarily reflected in our original data set: Australia, South Africa, and UAE. Google Trends also allowed us to understand how COVID related lockdowns impacted search trends around the category, providing critical insights to explain the sales blips in 2020 and early 2021. With the resurgence of gin cocktails across the globe, gin distillers must continue to differentiate themselves by highlighting their distinctive flavor profiles, regionality, and brand positioning demanded from the gin guest base. Fortunately, our client will benefit from the growing popularity and demand of Indian-based gin brands and flavor profiles as they eye their upcoming product launch within the next year.

Contrarily, the experience exploring whisk(e)y was quite cumbersome. The market has been posting robust double-digit growth in the last decade with fairly stable prices as more entrants try their luck. The term whiskey, although strictly controlled in certain regions, has no universal definition. Experts’ consensus points to a product that is distilled from a fermented grain-mash, but there are also producers (particularly those in India) using a molasses base instead and adding in flavoring and coloring to achieve a scotch-like profile. Our client would like to manufacture and export the latter product, which tends to have larger consumer bases in warmer, low to lower-middle income countries (African and South-East Asian). While a traditional bottle of lightly-aged scotch would sell for $35 and upwards in the United States, the market category that our client is targeting is around $8 to $13 a bottle.

“While a traditional bottle of lightly-aged scotch would sell for $35 and upwards in the United States, the market category that our client is targeting is around $8 to $13 a bottle.”

In order to estimate the size of the market, we collated data from Euromonitor, Statista, and official export records of the host country. Although the data did show robust growth potential for this market segment, the number of countries that could provide fertile ground for growth is debatable and fleshing this out will be the first order of business for our client. We provided the client with a quick hypothesis testing mechanism to see if the markets might be willing and able to accept another entrant at this price point. The idea would be to use differentiated marketing and packaging to set the product apart in the target markets. Some of the challenges we believe the client will face include, more premium products moving down the price scale, incumbents in the space reducing prices to remain competitive, and finally, whiskey tends to be a taste-dependent business at all price-levels creating high brand-affinity barriers. It is important to highlight that, similar to other alcoholic beverages businesses, the whiskey industry is consolidated among three to four global players, who command nearly 50% of the market.

Our Approach to Innovation

Combining concepts—such as the Adaptation, Aggregation, Arbitrage (“AAA”) triangle or Cultural, Administrative, Geographic, Economic (“CAGE”) framework—learned at Wharton, the CIP team conducted rigorous analysis to evaluate potential new markets on both their objective strengths and relative cultural preferences to the client’s host country.

“Our team conducted a rigorous analysis by combining a variety of concepts and frameworks learned at Wharton.”

The team engaged in understanding the type of product preference launch the customer was attempting to pursue. For craft gin, we were able to compile flavor profiles of the most popular options in each respective market, and share that information with the client as guidance for how our client should produce its gin – which was received well by the client. However, after developing a better understanding of our client’s production capabilities, it became abundantly clear that taste and quality would not be the differentiating factors for whisky.

With this newfound understanding, coupled with a considerable amount of data, we proposed that the company create a Ready-to-drink (“RTD”) whisky product that is differentiated in how it is packaged and marketed. As of late, RTD beverages have become increasingly popular, but there has been more of an emphasis on seltzers, and less so on cocktails. We believe this represented an advantageous void for our client, however, it was eventually determined that this idea should be set aside due to the technical lift.

Examples of RTD beverages currently on the market

Ultimately, it was determined that the client should focus on 1) leveraging existing capabilities, 2) leveraging existing relationships, 3) markets where customers have familiarity with Indian AlcoBev products, 4) markets that are increasingly becoming favorable, and 5) markets where regulations are in favor of India whisky entrants.

To learn more about the Mack Institute’s Collaborative Innovation Program and read interviews with alums from the program, click here.