Each semester, the Mack Institute’s Collaborative Innovation Program (CIP) brings Wharton and Penn students into some of the world’s top companies to solve organizational challenges. This past semester (Fall 2021), students consulted on a diverse lineup of live business challenges in industries ranging from metalworking to green banking.

The projects offer a window into the biggest trends, opportunities, and potential pitfalls in business strategy and innovation management. Below, we’ve rounded up some of the most interesting insights and key takeaways from our student consultants’ projects. Centered around some of the Mack Institute’s primary research areas, we’ve selected projects that relate to the following themes:

- Embracing New and Emerging Technologies

- Environment, Sustainability, and Governance

- New Players and Expanding Ecosystems

Part of a three part series

Theme 3: New Players & Expanding Ecosystems

Case Study E: Creating a Sales Strategy that Expands to High-Growth, Unicorn Companies

How can companies find the collaborators and clients that help them grow? Partnership and ecosystem strategy is another perennial focus of our CIP projects. One of our Fall ‘21 student groups worked with a multinational software company to create a sales strategy in efforts to attract high-growth, “unicorn” companies — the Fortune 1000 companies of the future. They conducted a number of internal and external interviews mapped to extensive market research to come up with data-based recommendations for the firm to build out their strategy playbook.

Excerpt from report:

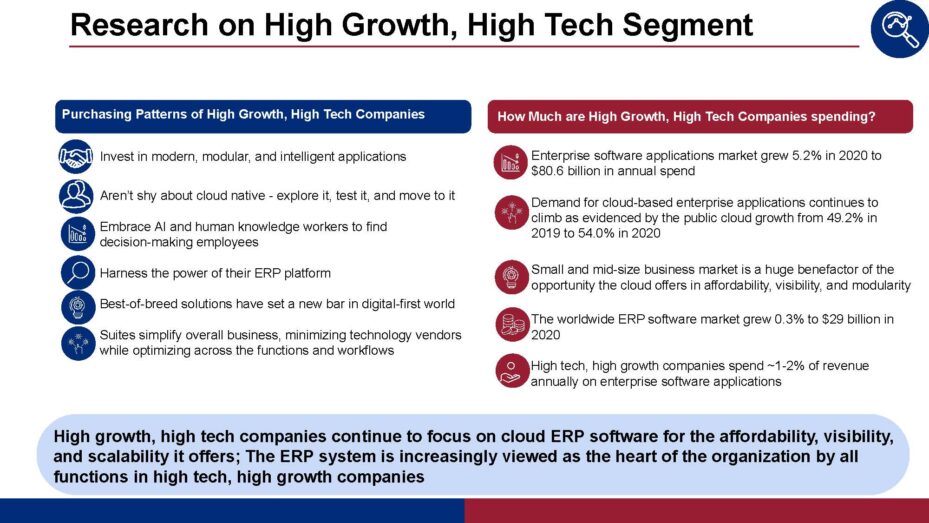

Observations and predictions on the market dynamics of the high tech, high growth segment:

By 2024, 70% of organizations will have transitioned to modular intelligent business suites, harnessing the business processes, data, and innovation across the enterprise in the simplest fashion. By 2023, 40% of Global 2000 Companies will be using their ERP systems as the data and transactional hub for their industry-based ecosystem. This means line-of-business (LOB) executives need to understand the requirements for the digital-first world so they can invest in modern, modular, and more intelligent enterprise applications.

The enterprise software applications market grew 5.2% in 2020 to $80.6 billion in revenue. Demand for cloud-based enterprise applications continues to climb as evidenced by the public cloud growth from 49.2% in 2019 to 54.0% in 2020.

That said, firms face major challenges in Modern B2B technology buyer. Complexity can quash a customer’s motivation to buy, and the field is increasingly complex. Inspiring and maintaining consumer confidence is key to growth. Additionally, over 80% of tech buyers look outside the internal buying committee. Positive representation on blogs, forums, et cetera is crucial, as is the customer’s personal relationship with a firm’s sales team or rep.

Spending Behavior of target segment:

The worldwide ERP software market grew 0.3% to $29 billion in 2020. ERP market growth was uneven in 2020 due to the global COVID-19 pandemic, which caused business disruptions and delayed some IT projects, many of them ERP system purchases. Preferred products remain – travel and expense, payroll and financial suite. As there is no generic basket of enterprise application software that high tech, high growth customers buy so we do not have an estimated number for annual spend for these high tech, high growth customers. Based on a customer interview that we have conducted, it appears that high tech, high growth customers spend ~1-2% of revenue annually on enterprise software applications.

Case Study F: Targeted Innovation Partnerships with University Ecosystems

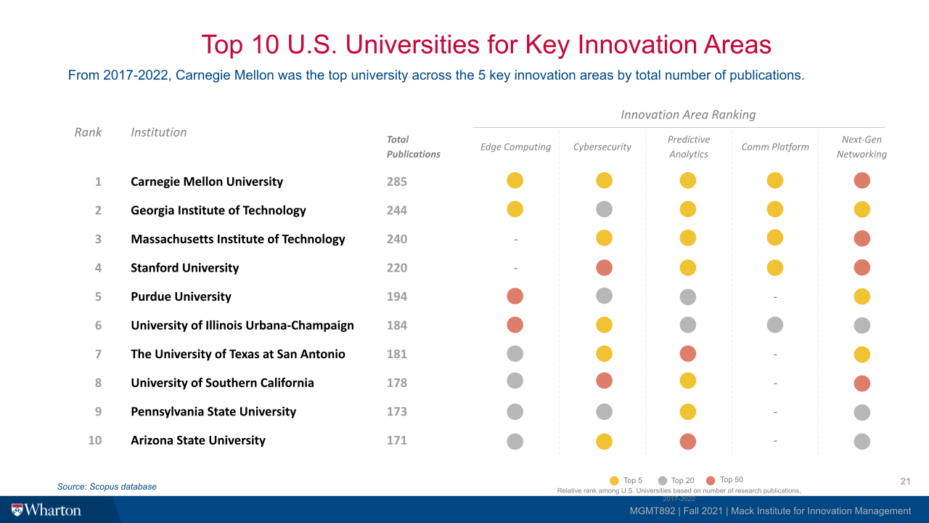

As a leading source of industry-academic collaboration at the University of Pennsylvania, the Mack Institute is uniquely positioned to explore how firms can build lasting relationships with universities that span beyond technology transfer programs. In one Fall ‘21 project, students worked with a leading global digital infrastructure services provider to explore that very issue. Students identified key innovation areas of importance to the client by conducting quantitative and qualitative analyses to identify top-ranked universities in particular technology areas, researching university engagement models, organizing interviews with technology transfer offices to gain direct insights into their innovation ecosystems. Ultimately, the team drew up a set of strategic recommendations via an engagement playbook and university-specific action points for six specific universities.

Excerpt from report:

University – Industry Partnerships and Engagement Framework

Partnership with universities is built on trust and credibility. Universities have different preferred engagement methods, ranging from having a dedicated external relations team to being incredibly decentralized with the corporation engaging differently with departments and research centers throughout the university. In order to be successful, corporations need to be prepared to commit both human and financial resources to these efforts. Moreover, the corporation must understand the university innovation ecosystem, especially the differences from industry related to culture, speed, and legal (i.e., intellectual property ownership, university indemnification).

The CIP team recommended a two-phased approach to establish broad university engagement to meet the client’s objectives and provide best practices going forward:

Phase 1 consists of foundation building inside firm: Building a dedicated university engagement team (with at least one dedicated role), identifying and prioritizing strategic technologies and finding top universities in areas of focus, defining specific goals for the corporation per technology, and establishing a presence and becoming familiar with the university partnership landscape by joining organizations like University Industry Demonstration Partnership (UIDP).

Phase 2 consists of discovering, landing, and expanding long-term partnerships. This phase entails engaging a wide spectrum of universities in low-touch models that help cast a wide net with low initial risk and resource intensiveness, identifying favored partners among a spectrum of universities, initiating a wider range of partnership models with select universities that the client can commit more resources and time to, and building long-term strategic partnerships with few select partners. There are many examples of low-touch models, including donating data, facilitating student competitions/forums, and becoming a member of a relevant consortium. A unique example of a low touch model involved a retailer providing anonymized data on-loan to Purdue University’s business school (viewed as a gift-in-kind) that opened the doors for further collaboration down the line.

School-specific actionable recommendations

Building university-specific knowledge is crucial for the corporation to establish a relationship with the university. The CIP team has created a template for university-specific battle cards that can be used when evaluating potential partners. These battle cards include university rankings in the client’s key focus areas, examples of corporate partnerships, key takeaways, engagement options measured by potential impact and resource intensiveness, and recommendations for how to initially engage with the university. It is also imperative to build metrics to track relationship value and understand the university’s perspective on partnership growth.

To learn more about the Mack Institute’s Collaborative Innovation Program and read interviews with alums from the program, click here.